Intro to Blockchain Bridges (Part 1)

A look at the rapidly growing cross-chain bridge ecosystem

This post started getting lengthy, so I’m splitting it into two.

Part 1: Intro to Blockchain Bridges

The macro narrative around them, and a tour of the bridge ecosystem. Most importantly, what can The Prestige teach us about how bridges work?

Part 2: Blockchain Bridge Analytics

TVL, usage/audience metrics, asset distribution, and a momentum analysis

🤷🏾♂️ Why care about bridges?

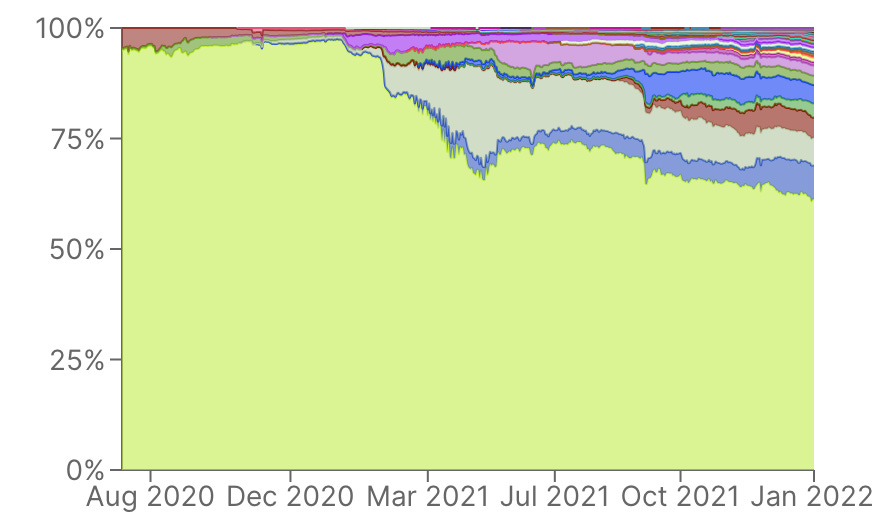

As we explored in prior posts, Layer 1s (L1s) grew tremendously in 2021. You could argue that L1 growth was the primary narrative of 2021. Ethereum went from 97% L1 dominance on Jan 1st, 2021 to 63% dominance a year later - a 34% absolute drop in market share. You can see this drop in lime green below:

In order for any of these alternative L1s to grow, capital needs to flow in & out. Many centralized exchanges (e.g. Coinbase, Kraken, etc) don’t support withdrawing assets to non-ETH chains. In fact, most of the time centralized brokers don’t sell you the native coin of a blockchain, but the ERC20 representation on Ethereum. E.g. Coinbase sells you the ERC20 version of MATIC not the native Polygon version of MATIC. Thus, bridges are essential to facilitate asset flow to alt-L1s. A lot of money moves across bridges. In the last 30 days alone, the Avalanche Bridge moved $4.6B.

While there are many crypto predictions for 2022, there is (general) consensus around two:

L1s and L2s will continue to grow and eat market share against Ethereum, especially until Eth2 is released and transactions cost over $100.

L1 and L2 growth increases the demand for multi-chain interoperability. Infrastructure will be needed to support billions of asset value transfer across chains.

Bridges support both these narratives. If you didn’t want to play favorites in the L1 battle, yet wanted to invest in the L1/L2 narrative, bridges would be akin to using the “picks and shovels” thesis. E.g. you could either invest in companies that mine Bitcoin (MARATHON), or you could invest in companies that creating mining equipment (BITMAIN).

Investing in bridges is “shorting” chain maximalism and “longing” a multi-chain future without having to pick favorites.

And for end-users, a more diverse bridge ecosystem that doesn’t have to route through Ethereum will lower costs and increase transaction velocity. Bridging assets to Ronin or Polygon through Ethereum costs hundreds of dollars. Wouldn’t it be nice to bridge directly from Polygon to Ronin?

🤔 How do bridges work?

Before we get into bridge analytics, let’s quickly review how a cross-chain token bridge works. When you’re trying to transfer assets from Ethereum to, say, Avalanche or Binance, or Polygon, what’s actually happening? Below is a simplified, layman’s explanation of bridges. The technical details get quite complicated and are outside the scope of this post.

1. Lock-and-Mint Bridges

In the movie The Prestige (spoiler alert), magician Alfred Borden invents a trick called the Transporting Man where Alfred enters one door and instantaneously transports to the other. In reality, the person that appears through the other door is Alfred’s twin, Freddy! The audience, unaware that Freddy is a twin, believes that Alfred has achieved the impossible.

Similarly, your original deposited token is not being transferred to the other chain - you are simply retrieving its twin! When you deposit your token into the bridge, it gets locked into the originating chain bridge contract. Then a contract on the destination chain mints/unlocks the equivalent amount of token. To the user, it looks like it the same token, but it’s a duplicate. When you transfer your token back, the operation happens in reverse: the token on the destination chain is burned and your original token is then unlocked.

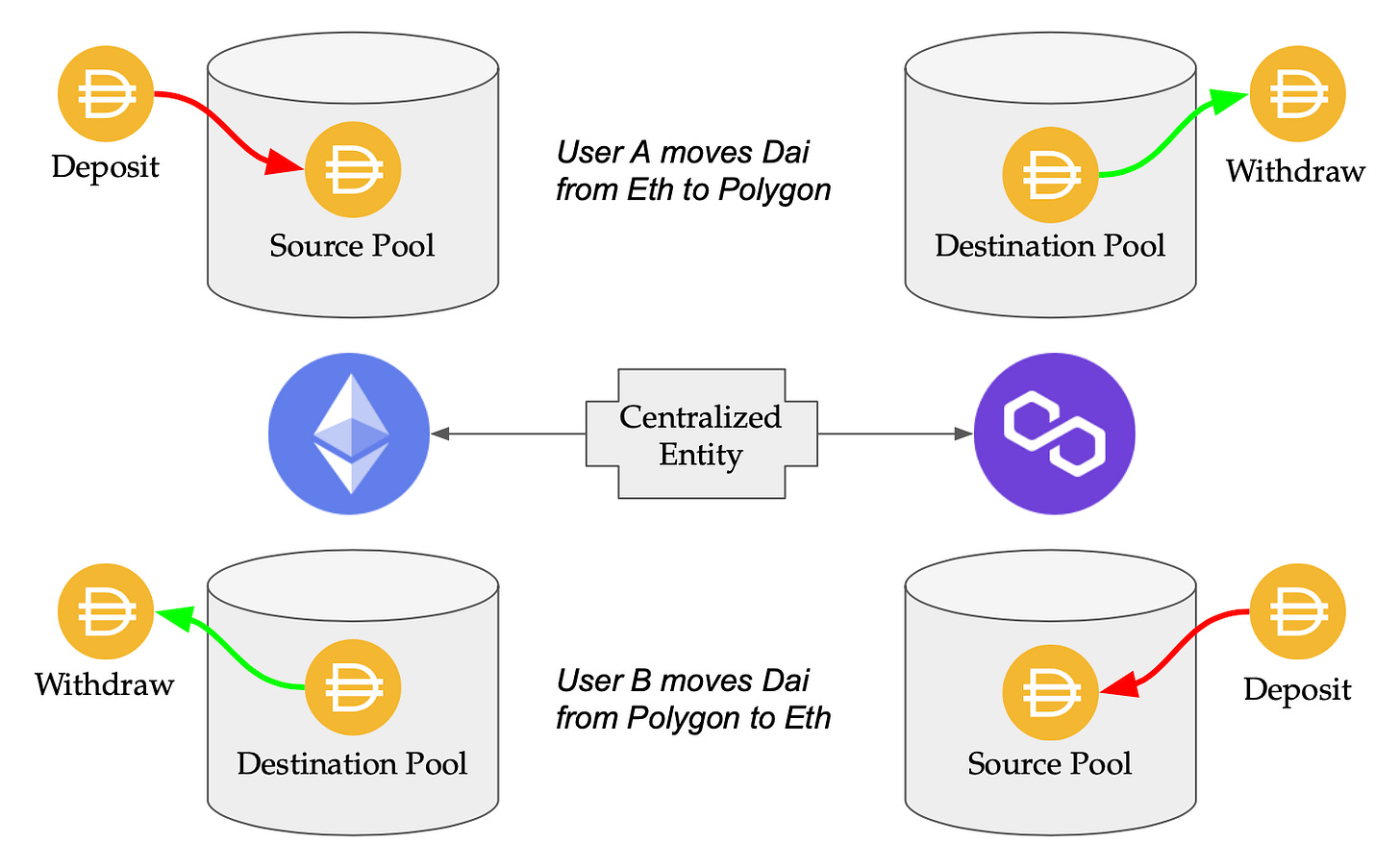

2. Liquidity Pool Bridges

Another popular method is to have shared liquidity pools on each blockchain maintained by a centralized entity. You deposit your assets on the source pool and withdraw the same amount of assets (but not your original ones) from the destination pool. If this happens at scale, there’s enough asset in both pools to ensure you don’t have to wait for the transfer. If you transfer a large amount of an obscure asset, then there’s a chance that asset does not exist (yet) on the other side. Then you’ll have to wait for a deposit by someone else. If you’re playing around with new assets or new chains, it’s easy to get “stranded” and have long transfer times.

The difference between the two is that in the Lock-and-Mint approach your assets are being locked by a smart contract and does not depend on someone else’s actions. In the liquidity pool approach, you’re at the mercy of the scale and actions of others.

What are the types of bridges?

From a business standpoint, there are a few types of bridges:

Ecosystem bridges: these are bridges created and maintained by the blockchain itself. The vast majority of ecosystem bridges only support one originating source: Ethereum. Their goal is simple: make it as easy and cheap to move assets from Ethereum to their blockchain. A few examples: Avalanche Bridge, Arbitrum Bridge, Binance Bridge, Cronos Bridge, Harmony Bridge, Polygon Bridge, Rainbow Bridge (NEAR), RSK Bridge, Optimism Gateway, Ronin Bridge (AXIE), Solana Wormhole, Terra Bridge.

Multi-chain bridges: these are chain-agnostic bridges that aim to support as many blockchains as possible. These are “many-to-many” bridges. They run brides as a business and collect small fees to develop and secure the bridge. A few examples: Multichain (formerly Anyswap), Synapse Bridge, RenBridge, Celer Network’s cBridge.

Cross-chain Liquidity Networks (DEXes): Often the first operation after bridging is to swap assets. For example, if you bridge ETH to Avalanche, you’ll probably swap some ETH for AVAX or other tokens in the Avalanche ecosystem. Cross-chain DEXes let users skip a step and swap directly into another blockchain. Instead of bridging ETH to Avalanche, just swap into AVAX directly. A few examples: THORChain, Dfyn.

Bridge-as-a-Service Protocols: There are B2B services being developed specifically for DeFi protocols rather than direct consumers. This would allow a protocol like Aave to offer a cross-chain transfer. Relay Chain is an example. Although normal users can use Relay Chain directly, it’s focusing its business on the B2B market.

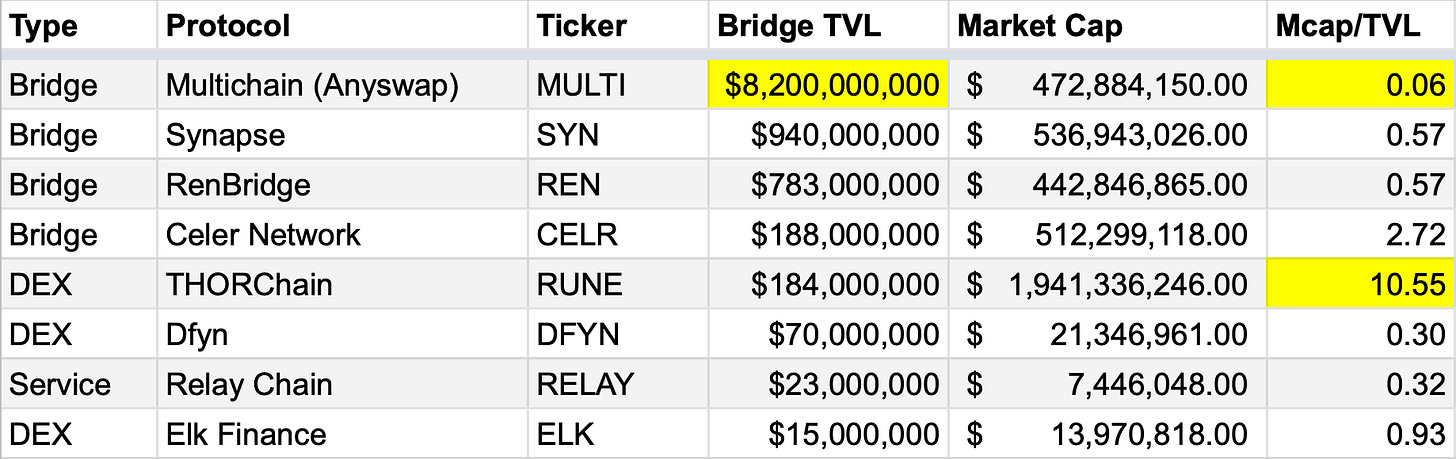

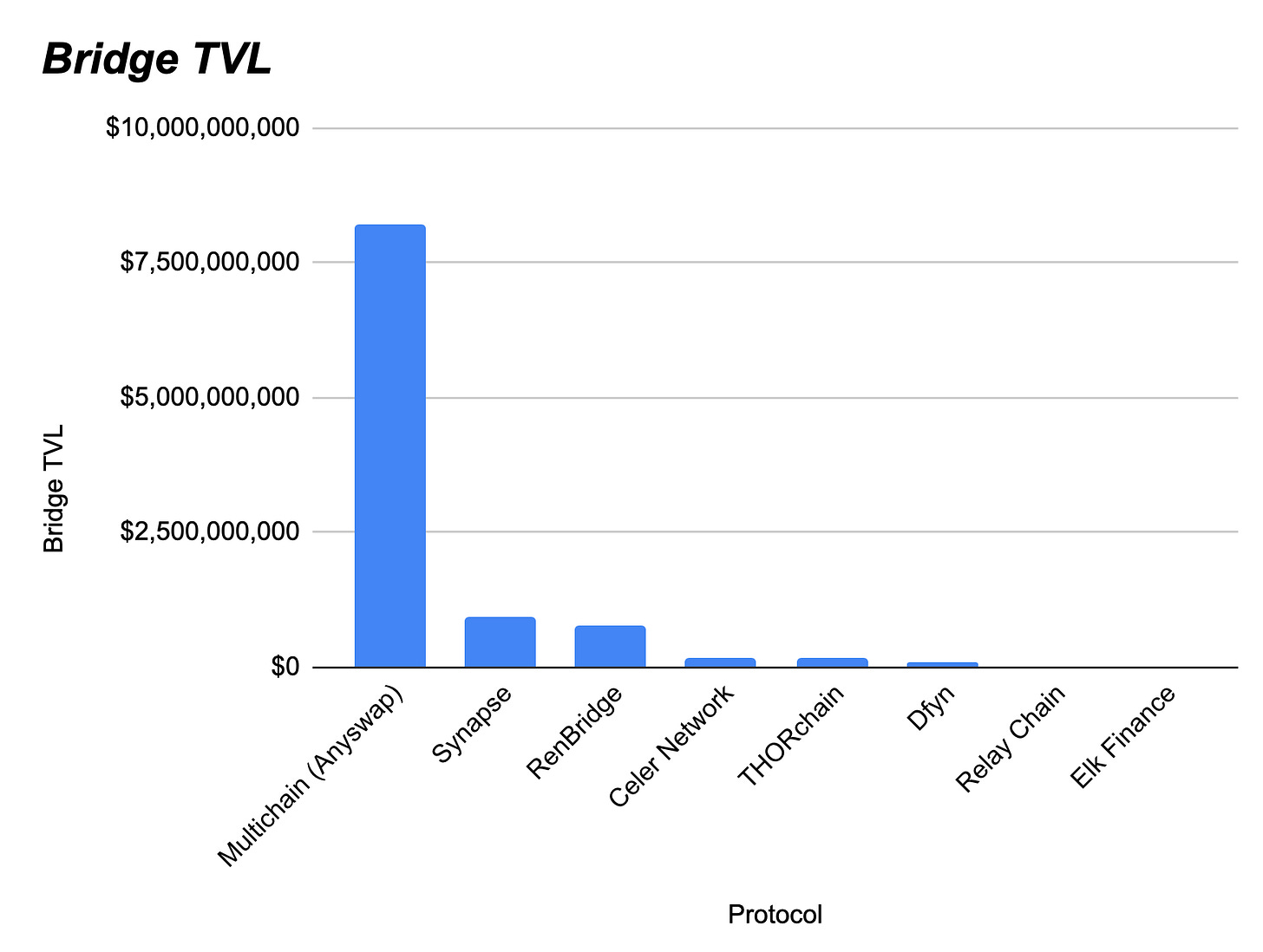

How big are these bridge protocols?

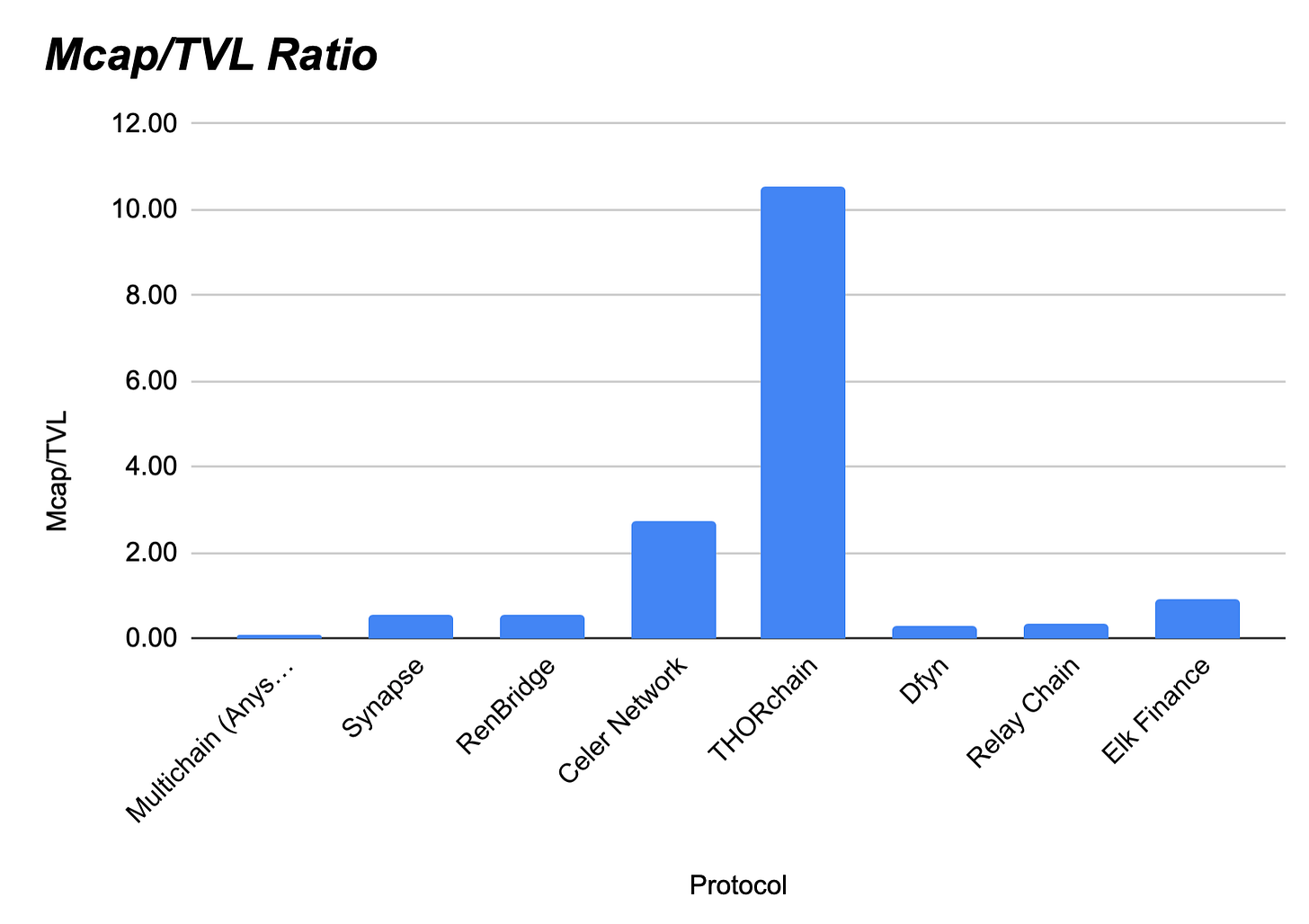

Looking at categories 3 and 4, we can pull up the market cap and TVL data. TVL for a bridge means the total asset value locked up in the bridge contracts. The ecosystem bridges, like Avax Bridge, don’t have their own tokens and aren’t revenue optimizing businesses.

Multichain (formerly AnySwap) is the largest bridge by a mile with $8.2B in TVL. While THORChain is the largest bridge by token market cap, it’s only has $184M in TVL. However, THORChain is in an extended test phase after a couple of infamous exploits and is not fully released yet.

Multichain is also notable in that it has the lowest Marketcap to TVL ratio. Multichain is one of those companies that everyone uses but no one talks about. THORChain is the most overvalued from this metric which puts a lot of pressure on it to perform once it exits the test phase.

👹 Bridge Chimeras

There’s going to be genre-mixing in this space. There are DEXes that will compete with Bridges by entering the cross-chain swap space. E.g. THORChain DEX competes with RenBridge. Theoretically, any large DEX (Uniswap, Curve) can become a cross-chain bridge with a Bridge-as-a-Service protocol.

Then, there are multi-chain bridges like RenBridge that will compete with L1s by becoming their own L1! Several multi-chain bridges have hinted at plans to become their own L1s, including RenBridge and Synapse.

⏭ Part 2

In part 2, we’ll explore bridge metrics like transaction volume, usage, asset value, and momentum.

Really enjoying your articles, looking forward to Part 2!